Featured

Table of Contents

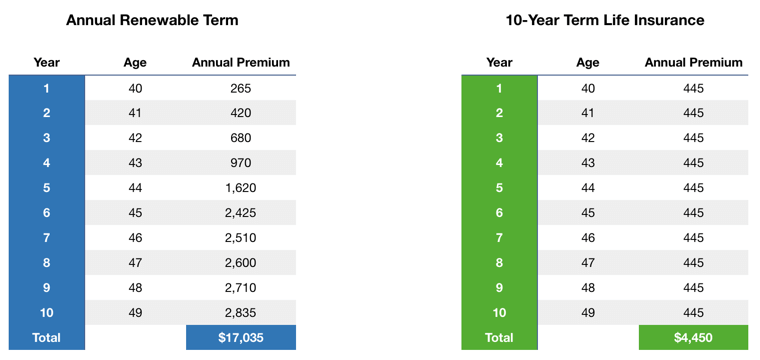

That commonly makes them a much more budget-friendly option forever insurance coverage. Some term policies might not keep the costs and death benefit the same with time. Level premium term life insurance. You do not intend to mistakenly think you're getting degree term protection and after that have your survivor benefit change later on. Lots of people get life insurance policy coverage to aid economically protect their liked ones in case of their unforeseen death.

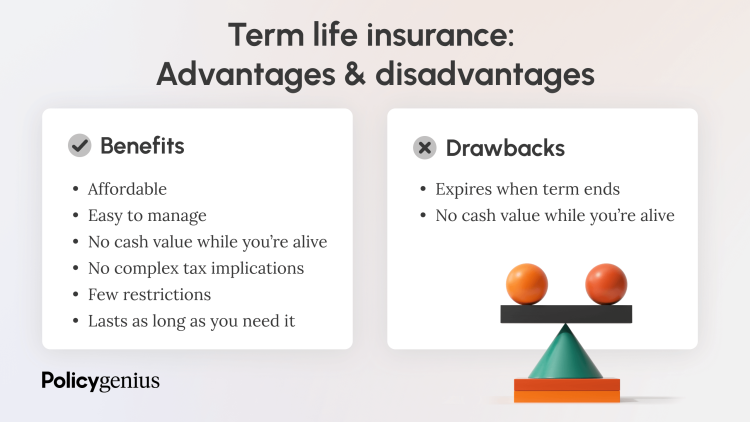

Or you might have the choice to convert your existing term protection into an irreversible policy that lasts the rest of your life. Different life insurance policy policies have potential benefits and disadvantages, so it is very important to understand each prior to you make a decision to purchase a plan. There are numerous advantages of term life insurance policy, making it a popular selection for insurance coverage.

As long as you pay the premium, your beneficiaries will certainly obtain the death advantage if you pass away while covered. That said, it is essential to note that the majority of plans are contestable for two years which suggests coverage can be retracted on death, should a misstatement be found in the app. Policies that are not contestable often have actually a rated survivor benefit.

How Does Annual Renewable Term Life Insurance Protect Your Loved Ones?

Premiums are typically less than whole life plans. With a level term plan, you can select your insurance coverage amount and the plan length. You're not secured right into a contract for the rest of your life. Throughout your plan, you never have to fret about the premium or death advantage quantities transforming.

And you can't squander your policy during its term, so you will not receive any type of financial take advantage of your past protection. Similar to various other sorts of life insurance policy, the cost of a level term policy depends on your age, insurance coverage demands, employment, way of living and health. Generally, you'll locate a lot more cost effective protection if you're younger, healthier and much less high-risk to guarantee.

Because level term costs remain the very same for the duration of protection, you'll recognize exactly just how much you'll pay each time. That can be a huge assistance when budgeting your costs. Degree term protection also has some flexibility, enabling you to tailor your policy with additional features. These frequently can be found in the type of riders.

The Benefits of Choosing Simplified Term Life Insurance

You might have to satisfy certain conditions and credentials for your insurance firm to enact this motorcyclist. On top of that, there might be a waiting duration of up to six months before taking result. There likewise could be an age or time limitation on the protection. You can include a youngster biker to your life insurance coverage plan so it likewise covers your youngsters.

The death advantage is commonly smaller, and protection usually lasts up until your child turns 18 or 25. This cyclist might be an extra economical method to assist ensure your youngsters are covered as riders can commonly cover numerous dependents at when. As soon as your kid ages out of this coverage, it may be possible to transform the motorcyclist into a new policy.

When contrasting term versus irreversible life insurance policy, it is essential to bear in mind there are a few different types. One of the most typical sort of permanent life insurance policy is whole life insurance policy, however it has some key distinctions contrasted to degree term protection. Guaranteed level term life insurance. Here's a standard introduction of what to take into consideration when contrasting term vs.

Whole life insurance policy lasts permanently, while term protection lasts for a certain period. The costs for term life insurance policy are normally reduced than whole life protection. With both, the costs remain the very same for the duration of the plan. Whole life insurance policy has a cash worth element, where a portion of the premium might expand tax-deferred for future requirements.

One of the major functions of level term coverage is that your costs and your death advantage don't alter. You might have coverage that starts with a death benefit of $10,000, which might cover a home loan, and then each year, the death advantage will certainly decrease by a set amount or percentage.

Because of this, it's usually a more economical sort of degree term coverage. You may have life insurance coverage through your employer, but it may not suffice life insurance policy for your needs. The very first step when buying a plan is identifying just how much life insurance coverage you require. Take into consideration variables such as: Age Family members dimension and ages Employment status Earnings Financial debt Lifestyle Expected last costs A life insurance policy calculator can help figure out just how much you require to begin.

What is Term Life Insurance For Seniors? A Guide for Families?

After determining on a policy, complete the application. If you're authorized, authorize the documentation and pay your very first premium.

You might desire to update your recipient details if you've had any kind of considerable life changes, such as a marital relationship, birth or separation. Life insurance policy can occasionally really feel complicated.

No, level term life insurance coverage doesn't have money value. Some life insurance policy policies have an investment function that allows you to develop money value over time. A section of your premium payments is reserved and can earn passion gradually, which expands tax-deferred during the life of your coverage.

These plans are typically considerably more expensive than term insurance coverage. If you get to the end of your plan and are still to life, the coverage finishes. Nevertheless, you have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your insurance coverage has gone out, for instance, you may intend to get a brand-new 10-year level term life insurance coverage policy.

How Does Voluntary Term Life Insurance Help You?

You might have the ability to transform your term insurance coverage right into an entire life policy that will certainly last for the rest of your life. Many kinds of degree term plans are exchangeable. That indicates, at the end of your coverage, you can convert some or every one of your policy to whole life coverage.

A degree premium term life insurance plan lets you stick to your spending plan while you aid safeguard your family. ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program administration operations of Fondness Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc .

Latest Posts

Instant Online Life Insurance

What Is The Difference Between Life Insurance And Burial Insurance

Instant Life Insurance No Exam