Featured

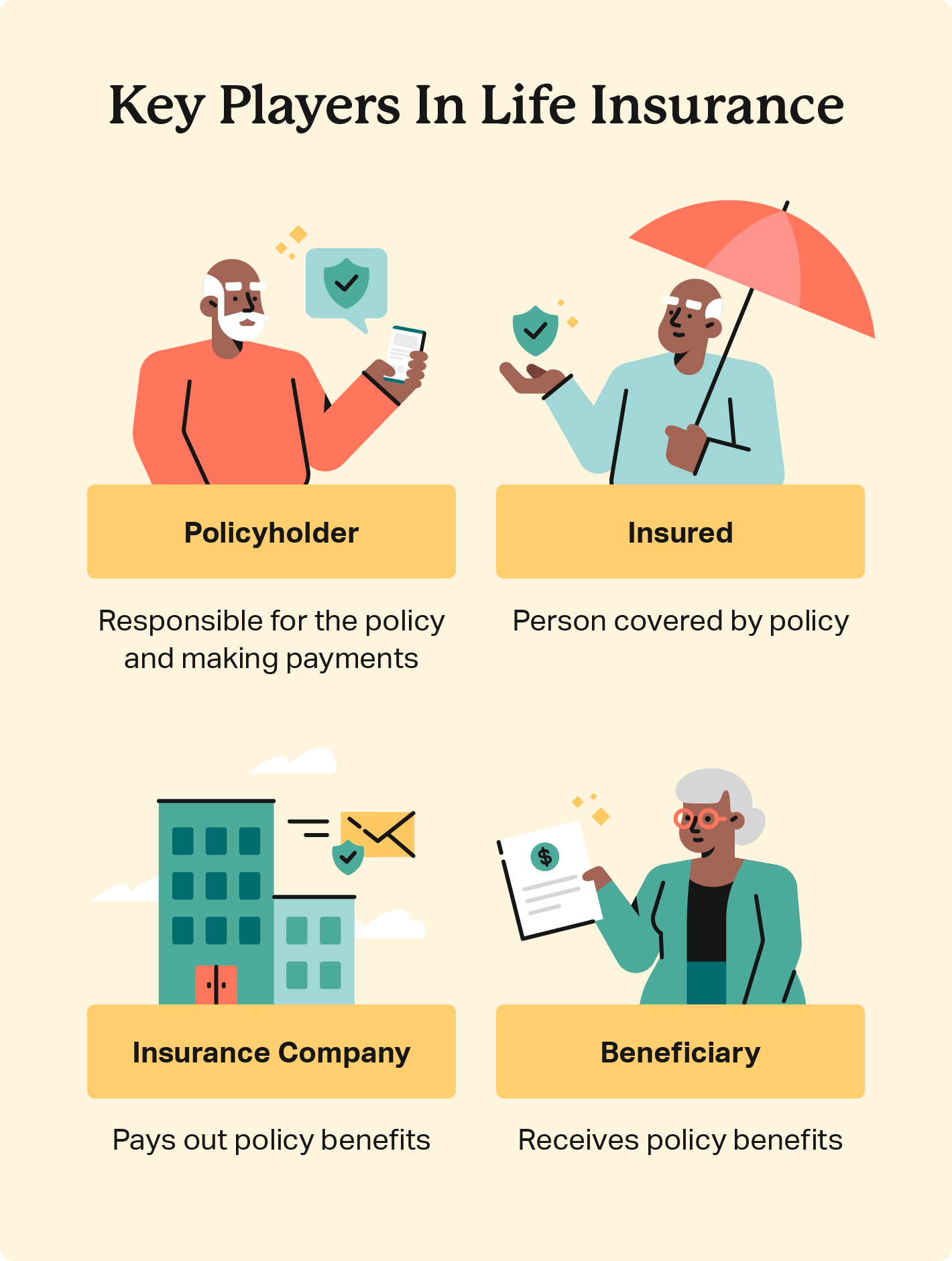

Cash worth is a living benefit that continues to be with the insurance provider when the insured dies. Any impressive lendings versus the money value will decrease the policy's death benefit. Living benefits. The policy owner and the insured are normally the same person, but in some cases they may be different. A business might buy crucial person insurance coverage on a vital worker such as a CEO, or a guaranteed might offer their own policy to a third party for money in a life negotiation - Mortgage protection.

Latest Posts

Instant Online Life Insurance

Published Apr 04, 25

3 min read

What Is The Difference Between Life Insurance And Burial Insurance

Published Apr 02, 25

9 min read

Instant Life Insurance No Exam

Published Apr 01, 25

7 min read