Featured

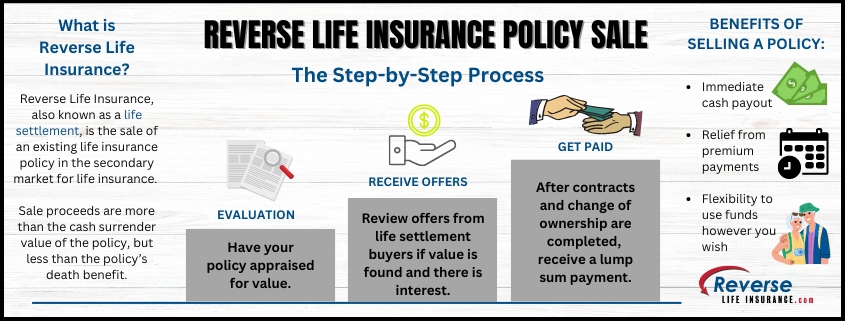

Money worth is a living benefit that remains with the insurer when the insured dies. Any kind of outstanding loans against the cash money worth will certainly reduce the plan's fatality advantage. Living benefits. The policy proprietor and the insured are generally the very same person, yet occasionally they might be various. As an example, an organization could purchase crucial person insurance coverage on a vital worker such as a CHIEF EXECUTIVE OFFICER, or a guaranteed may market their very own policy to a third party for money in a life negotiation.

Latest Posts

Instant Online Life Insurance

Published Apr 04, 25

3 min read

What Is The Difference Between Life Insurance And Burial Insurance

Published Apr 02, 25

9 min read

Instant Life Insurance No Exam

Published Apr 01, 25

7 min read